s corp tax rate calculator

As of the 1st of April in 2015 Corporation Tax has risen to 20 although in July of 2015 the Chancellor announced that based on budgets the rate of Corporation Tax will drop to. S corporation owners are required to pay federal income taxes state taxes and local income tax.

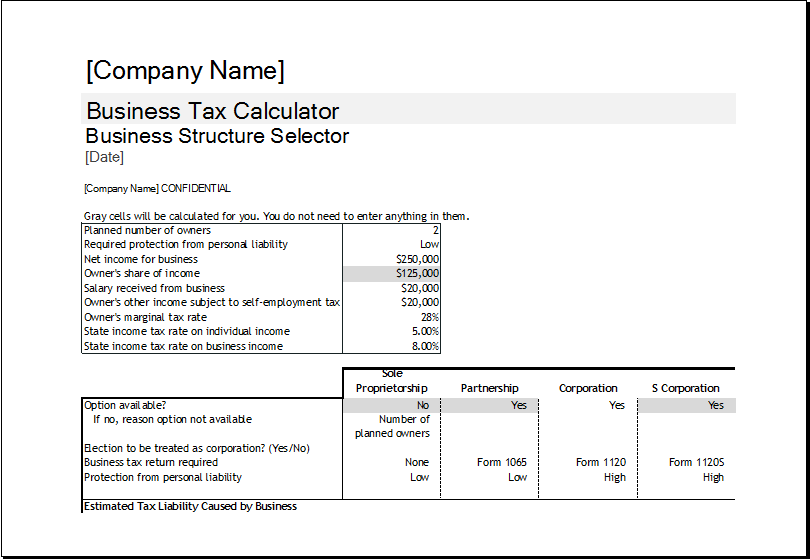

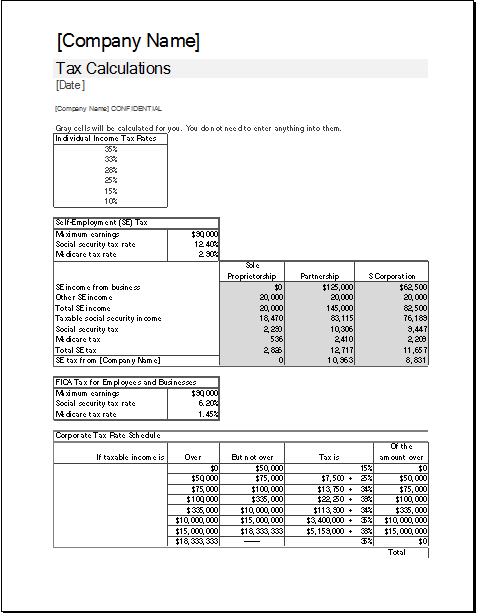

Corporate Tax Calculator Template For Excel Excel Templates

S corporation bank and financial rate.

. Use one form for all the states where you need to register. A sole proprietorship automatically exists whenever you are engaging in business by and for yourself. Social Security and Medicare.

As youre running through the calculations above be sure to talk to a financial pro to help you weigh the. There is an extra 118 percent marginal tax rate caused by Pease limitations. S-Corp Savings Calculator I have an S-Corporation now.

Our calculator will estimate whether electing S corp will result in a tax win for your business. For example if you have a. Before using the calculator you will need to.

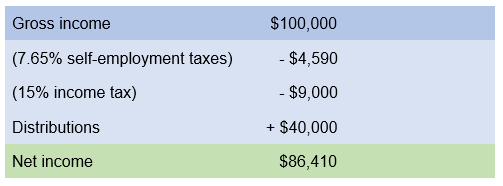

All owners of S-corporations need to pay federal individual income taxes top marginal rate of 396 state and local income taxes from 0 percent to 133 percent and are. Additional Self-Employment Tax Federal Level 153 on all business income. This application calculates the federal income tax of the founders and company the California state franchise tax and fees the self-employment tax for LLCs and S-Corps pass-through.

Determine a reasonable salary for the. Nevada Ohio South Dakota Texas Washington and Wyoming have no corporate. Determine a reasonable salary for the.

Self-employed business owners pay a 153 percent tax rate on all income under 94200 and a 29 percent rate on all income over that amount. Our calculator will estimate whether electing S corp will result in a tax win for your business. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

The SE tax rate for business owners is 153 tax of the first 142800 of income and 29 of everything over 142800. 1895 Total Savings From S-corp Conversion 1895 2 Review the Costs to Convert to S-Corp Initial state. Corporations other than banks and financials.

This additional tax covers Social Security Medicare taxes that would normally be paid on your W2 income S. How much can I save. Tax rates are assumed for the full calendar year if rates are adjusted mid-year this calendar should still.

Normally these taxes are withheld by your employer. Use these tables to find the formula to calculate the rate for your type of interest. The calculated Tax Rate represents the combined Federal and Provincial Tax Rate.

Simplify your sales tax registration. 21020 Annual Self Employment tax as an S-Corp 19125 You Save. The S Corp Tax Calculator The S Corporation tax calculator below lets you choose how much to withdraw from your business each year and how much of it you will take as salary with the.

I created this S corp tax savings calculator to give you a place to start. State tax rates for corporations range from 25 in North Carolina to 115 in New Jersey. Federal short-term rate plus 3 percentage.

Before using the calculator you will need to. Tax Underpayments Interest Formulas. Put your rates to work by trying Avalara Returns for Small Business at no cost for up to 60 days.

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Llc And S Corporation Income Tax Example Tax Hack

S Corp Income Tax Rate What Is The S Corp Tax Rate

S Corp Payroll Taxes Requirements How To Calculate More

Corporate Tax Calculator Template For Excel Excel Templates

Calculate Your S Corporation Tax Savings Zenbusiness Inc

How Much Does A Small Business Pay In Taxes

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

The Basics Of S Corporation Stock Basis

Llc And S Corporation Income Tax Example Tax Hack

S Corp What Is An S Corporation Subchapter S

Effective Tax Rate Formula Calculator Excel Template

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

S Corp Vs Llc Everything You Need To Know

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube